The EU aims to fully replace the existing ICS with the entirely new ICS2! Here are the most important facts you need to know about this transition.

ICS2 – Import Control System 2

The Import Control System 2 (ICS2) is the new customs advance cargo information system of the EU. The system aims to collect data about all goods entering the EU prior to its arrival and will be applied to reinforce customs risk management and to ensure security and safety to all EU citizens. It represents a core EU customs instrument with the goal to manage entry security and safety border controls and to protect the EU internal market as well as EU consumers.

ICS2 will be a central EU system implemented by the European Commission. The benefit of the new system is clearly the “Shared Trader Interface” (STI) which can be seen as one single service interface for traders in all EU member states. The European Commission provides EU member states the possibility of using the new STI and sending Entry Summary Declarations (ENS) directly to ICS2 OR providing a national service interface on their own (such as ATLAS in Germany).

With the new system the filing of advance cargo information by multiple supply chain partners for one single declaration will be introduced (such as 10+2 in the US). While carriers currently bear full responsibility for Entry Summary Declarations (ENS), importers potentially have to add related data by themselves in future.

The system will support the following processes:

- lodgement of the Entry Summary Declaration (ENS) (advance cargo information) to customs

- security and safety risk analysis by customs

- arrival of means of transport

- presentation of goods to customs, and

- control by customs of goods, where required

ICS2 Timeline

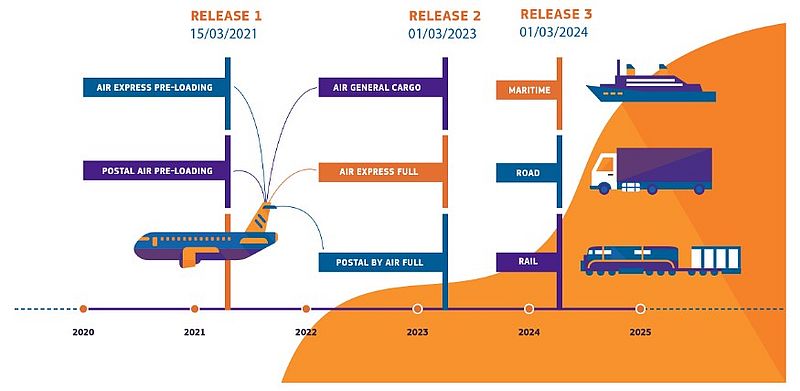

The new system will be introduced in three release phases. Economic Operators (EOs) will begin declaring safety and security Entry Summary Declaration (ENS) data to ICS2 in a stepwise approach. This depends on the type of services they provide regarding to international movement of goods.

Each release phase affects different EOs and modes of transport, as the figure below shows:

- Release 1 – 15.3.2021: Air postal and express consignments

- Release 2 – 01.3.2023: Goods in Air traffic

- Release 3 – 01.3.2024: Goods in Maritime and inland waterways, Road and Rail traffic

Who is affected?

The new ICS2 will directly affect all Economic Operators involved in handling, shipping and transporting of cargo, express or postal consignments, such as:

- Postal operators within/beyond EU;

- Express delivery services;

- Air cargo carriers;

- Freight forwarding logistics companies;

- Ultimate consignees established in EU (for goods received via maritime transport);

- Maritime, railway and road carriers;

- Representatives of above.

Furthermore, all manufacturers, exporters, and individuals from outside the EU who are sending goods to or through the EU will be affected indirectly by this change.

What does that mean to your business?

As soon as ICS2 is in place, certain EOs will be required to send the necessary data to the system depending on the respective release phase. If you won’t do so, consignments/cargo will be stopped at EU customs border. This means that customs will not proceed with goods clearance. In addition, poor quality declarations will either be rejected or subject to unnecessary interventions and may result in sanctions for non-compliance.

Therefore, Economic Operators (EOs) with existing ICS obligations need to upgrade their systems. But more important, with ICS2 also EOs without ICS obligations today might have ICS obligations starting with 2024 and must therefore prepare for it.

How can I prepare for ICS2?

In order to prepare your business for this major transition from ICS to ICS2, some preparations are crucial.

First of all, analyze your business processes to evaluate if and how you are affected by ICS2. If this change affects your company, then adjustments of your business processes to the new system are necessary. Furthermore, it is important to take steps to ensure high-quality, precise data is provided. Finally, it is important to develop or update your IT systems for exchange of information and to provide training to your staff.

Detailed information about the new ICS2 can be derived from the authorities like the EU commission: https://ec.europa.eu/taxation_customs/general-information-customs/customs-security/ics2_en

However, if you have further questions about the new Import Control System 2 (ICS2) we are more than eager to discuss them with you – simply contact us via sales@mic-cust.com.