Automakers challenged with regulatory uncertainty, supplier unavailability and logistical bottlenecks

Resilience360, a leader in supply chain risk management solutions, today released insights on the current impact of COVID-19 on the European automotive industry and recommendations for moving forward. Throughout the month of May, Resilience360 researched 244 European assembly and component plants of major car makers to understand how the severity of the COVID-19 outbreak in countries with a strong automotive industry has impacted the sector. Some insights from the report:

- Rising Component Prices: Persistent capacity shortages in the air freight market are creating record-high prices of component parts, particularly out of Asia.

- Supplier Insolvency: Key suppliers have been forced to file for insolvency or bankruptcy proceedings, with more than 350 recorded automotive-related company insolvencies in April-May.

- Widespread Furloughs: At the beginning of April, more than 1 million workers had been furloughed at large car makers and suppliers, according to data released by the European Automobile Manufacturers’ Association (ACEA). The industry accounts for more than 11 percent of all manufacturing jobs in the European Union, highlighting the economic importance of the sector for the entire continent.

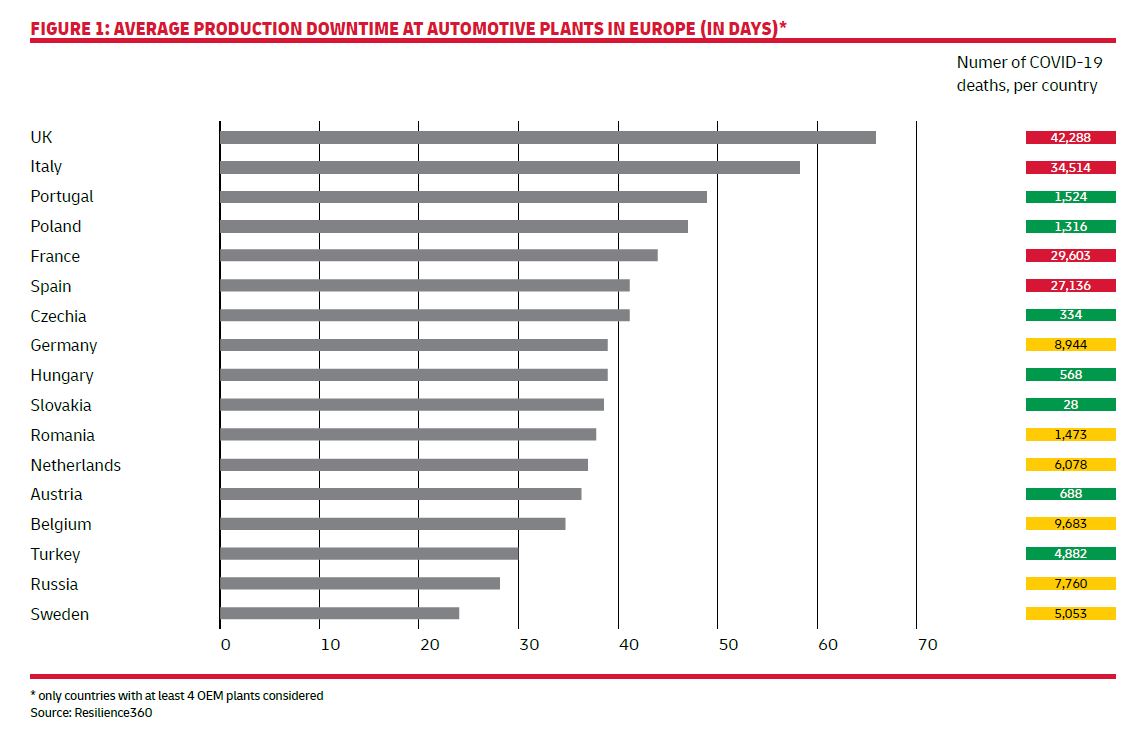

- OEM downtime correlates with COVID-19 fatalities: A very high number of COVID-19 related cases and fatalities (10,000 or higher) has, in most cases, correlated with a long average downtime at Original Equipment Manufacturer (OEM) plants. The two European countries with the highest number of COVID-related fatalities, the United Kingdom and Italy, have had the longest average production shutdowns, 67.3 days and 58.8 days respectively, at OEM plants, since these nations have had more severe government-mandated lockdowns. Companies across industries can look to this notable factor when planning forward-looking contingency measures for a potential second wave of infections.

“In the just-in-time supply chain environment of the automotive industry, procurement and logistics managers can consider adjusting inventory levels according to the risk of a renewed regional or national lockdown that might disrupt inbound supply availability for a certain period of time,” said Mirko Woitzik, Mirko Woitzik – Manager EMEA, Risk Intelligence for Resilience360. “While holding larger levels of stock may not always be financially viable, planning with varying levels of stock in countries with major production footholds will increase supply chain resilience as production re-starts.

“Supply chain professionals should prepare for further disruptions in the coming weeks and months as start-stop production could become part of the new normal for manufacturing companies.”

The Resilience360 report also offers recommendations for supply chain professionals to prepare for future COVID-19 infection waves and supply chain disruptions and to handle supplier unavailability and other logistical issues. These recommendations include monitoring fatality numbers in key locations, keeping track of regulatory changes and planning production resumption schedules, adhering to new health and safety protocol, exploring alternative transportation options and monitoring financial distress on the supplier level.

Resilience360 predicts, monitors, and mitigates disruptions both man-made and natural, including hurricanes, cyberattacks, labor strikes, protests, and a rapidly changing regulatory environment.